With 2013 just around the corner, should you include applying for your vacation rental business license to your year-end checklist? As discussed in last week’s blog, local and state governments are cracking down on vacation homeowners who are not paying required lodging taxes. Compliance is not difficult, but it can be tedious and confusing.

Homeowners can renew their existing licenses by clicking on the applicable link below and following the instructions for “MUNIRevs”. Homeowners who are in need of a business license can also use the local government links below, however they will first need to apply for a sales tax number. Clicking on the State of Colorado link can access the required form: Click Here

Business Licenses Renewal/Application Links

For Town of Telluride Click Here

For Mountain Village Click Here

Once the application is submitted, homeowners will be provided with tax filing forms. Sales tax forms will need to be periodically filed with their local tax office and the Colorado Department of Revenue.

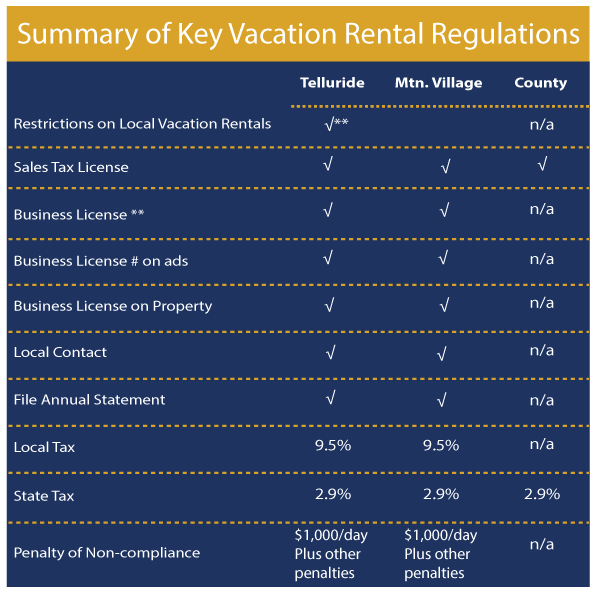

Provided below is a summary of the primary requirements for vacation rental regulations in the Telluride area. For a complete listing of requirements, please contact VRS (970) 728-4202 (email VRS) or your local governmental office, Town of Telluride (970) 728-2175 or Mountain Village (970) 369-6408.

*County considering regulations

**Three rentals per year for maximum of 29 days in residential areas

Given the significant penalties of non-compliance combined with state and local governments’ heightened interest in collecting tax revenues, it only makes sense for homeowners to become compliant. At VRS we want to take the hassles out of ensuring your property is compliant with state and local regulations, which is why we offer an affordable Rental Compliance Plan. For a low monthly fee of $65, VRS can provide peace of mind that your property meets the requirements.