Vacation rental homeowners consistently rank increasing rental revenues as their number one objective. Rental reviews can be powerful fuel to supercharge your revenue.

Consumers naturally seek the input and advise of others when making major buying decisions such as selecting vacation rentals. Often this advice comes in the form of customer reviews, which provides third-party validation of the vacation rental. Enlisting your guests to comment on their experience may be your path to increased bookings.

Fortunately, many online listing services such as VRBO, Homeaway and Flipkey make it easy to obtain and display guest testimonials. The key is, first, to have a plan to collect reviews and second, to feature reviews in your online listing and in guest communications.

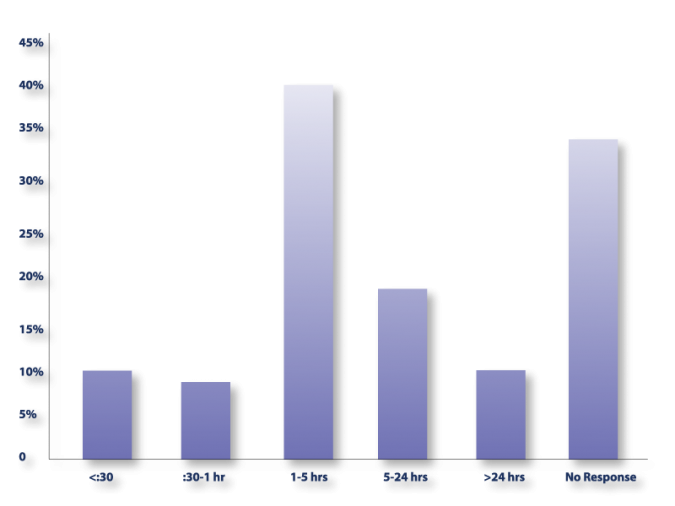

We recommend that you contact guests soon after their departure to thank them for choosing your property and request suggestions on how their stay could have been improved. This is also an opportunity to ask them to write a review. Including a link to your review page will make it easier for guests to comment. Most guests are happy to provide feedback if requested to do so.

Once you have gathered guest reviews, it is important that you direct prospective guests to your reviews. This can be accomplished by including statements such as “highly reviewed property,” “see property reviews…,” etc. in your listing description. Additionally, in communications with prospective guests, encourage them to read previous guests’ commentaries.

Be prepared for both good as well as bad reviews. Most consumers are savvy enough to discern the validity of a bad review, however, the number of positive versus negative reviews will be an important consideration. You may want to consider listing your property on Flipkey, a subsidiary of Tripadvisor, which allows homeowners to respond online to guest reviews. This interaction between you and your guests can be particularly effective.

Using customer feedback to drive revenues is a proven marketing technique. Like most effective marketing tools it must be actively managed and promoted in order to realize the full benefit.

At VRS we recognize the importance of guest testimonials, which is why we have incorporated them into our Rental Management Plan. As part of our quality control function, we contact guests soon after their departure to thank them for choosing the property, to request feedback on the property and to request that they provide a property review.